- WuhooPoints

- Posts

- Things You Should Know Q4

Things You Should Know Q4

A recap of the changes in the points & miles world

There’s always new and exciting updates to the points & miles world that can really make our lives easier and travel more luxurious.

Points Program Updates

Rove is the talk of the town:

You’ve heard me talk about shopping portals like Rakuten and Kudos, but Rove is a focused hotel shopping portal on steroids. Yes it still has similar earn rates on various retailers, but where you’re really going to get value from is through booking hotels.

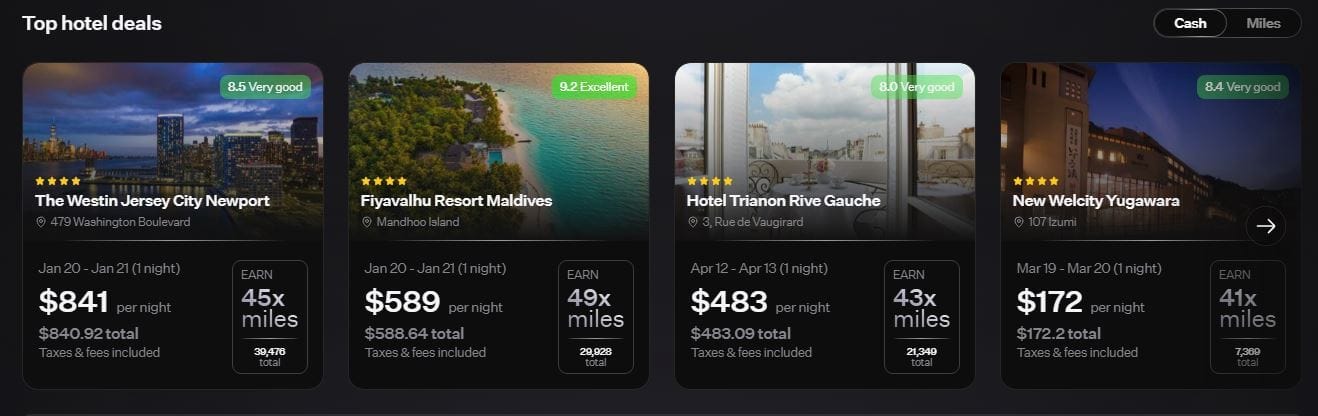

You can see below - you can get up to 49x miles back from a hotel purchase! But do you know what the best part is..?

Rove top hotel deals

The miles aren’t just normal cash back - they are transferrable! Meaning the 49x miles you earn can be transferred to Air France Flying Blue, Qatar Airways Privilege Club, and a lot more. And if you’re new, that also means the 49x miles can double, triple, or even 10x their value depending on where you’re redeeming your points.

And the huge announcement this week is you can now transfer Rove miles to Lufthansa Miles & More. This is EXCLUSIVELY a Rove ability as no other bank or programs transfers to Lufthansa - which has great redemptions on its own flagship products, but also many other Star Alliance sweet spots.

What’s the catch?

While I’m excited at these innovations to the points & miles world, I probably won’t be using Rove that much. My personal travel/redemption style is to book Hyatt hotels with Chase points or smaller boutique hotels when I need to with my credits. I very rarely will use the Rove portal to book a hotel then and capitalize on the sweet bonuses. But when I do, a good thing for me is that I can triple-dip when I book a Hyatt - I get Rove miles, credit card miles, AND Hyatt points. Unlike third-party bookings, Rove bookings also get access to your loyalty benefits and perks, so that’s a great plus.

If you book hotels with cash, definitely check out Rove, and use my referral link for some extra miles!

Advertisement

Adver

Card Pointers can help you keep track of your cards and tell you which one to use at different places. If you want to +membership, use our link to get a discount (and help us out)

Bank Program Updates

Let’s get back to the classic banks and their updates - unfortunately, not as much good news.

Chase

No more business ink referral cycles - you can only get a referral bonus for referring someone to an ink card if they never had any Chase ink cards before. One silver lining is that Rakuten will occasionally provide bonuses on several Chase cards, so watch out for those.

More on inks Chase is pushing for EINs over Sole Proprietors - we don’t know what this exactly entails, but likely it’ll be harder to get a business card just as a sole proprietor using your own SSN. The workaround here is to just get a free EIN from the government and file an LLC for $50-$200 depending on your state. That gives you access to plenty business cards.

There are mixed data points on how Chase is relaxing their one Sapphire bonus rule - so I encourage you to try and let me know what happens! I will probably get Sarah to apply for a Sapphire card in the new year and can update you then!

Capital One

Capital One has formalized their Venture/Venture X rules. All you need to know is that you can’t get the Venture bonus if you’ve gotten the Venture X bonus within the past 4 months. You can get the Venture X bonus if you’ve gotten the Venture bonus before. I don’t think this is a huge issue except for the niche group of bonus hunters. I just don’t think the Venture card is that useful.

Capital One is updating some of their cards (debit mostly to start) to the Discover network. You might be getting a new card in the mail, so watch for that. I don’t think it’s a huge issue as the cards you would use abroad are still Visa/Mastercard.

New Cards

Lots of new cards that are out. We’re no longer updating the tier list, as we have a new ranking system coming up in the new year, stay tuend!

Citi AAdvantage Globe - AA’s newest mid-tier card for those avid AA travelers that don’t care/need the lounge access of the executive card.

Gemni - The newest crypto card to launch. Obviously not useful for the points & miles world, but it can be a decent hedge/diverse card in your portfolio depending on your goals since it can earn up to 4% back depending on how much crypto you’re holding.

US Bank Split - A unique card that automatically puts your purchases into a 3-part payment plan. I tend to not like BNPL features because it typically makes you spend more than you should. But if you can take advantage of these features, go for it!

Current Transfer Bonuses

Bank | Program | Bonus | End Date |

|---|---|---|---|

CCapital One | British Airways (and thus all Avios) | 20% | November 21 |

American Express | Marriott | 30% | November 30 |

American Express | Avianca LifeMiles | 15% | November 30 |

Rove | Finnair (and thus all Avios) | 20% | December 31 |

Our lineup for this week is below. See our rationale here just for newsletter subscribers like you.

Matthew: World of Hyatt Business, World of Hyatt, Chase Ink Business Unlimited

Sarah: Chase Ink Business Cash

Did you receive this newsletter from someone? Subscribe now to stay updated of new blog posts and exclusive content.

About WuhooPoints

WuhooPoints focuses on the credit card consultation side of Wuhoo Group. We help you unlock the power of your credits cards for free luxury travel.