- WuhooPoints

- Posts

- I'm trash - you should probably unsubscribe

I'm trash - you should probably unsubscribe

I was wrong on most of my 2025 credit card predictions

I made a bunch of predictions last year thinking I was an expert in the points & miles world, but I was mostly wrong. Sure, some of them were reaches/wishes, but to balance it out, most of the ones I got right were in consensus with industry rumors. See where I went wrong and then… my predictions for 2026!

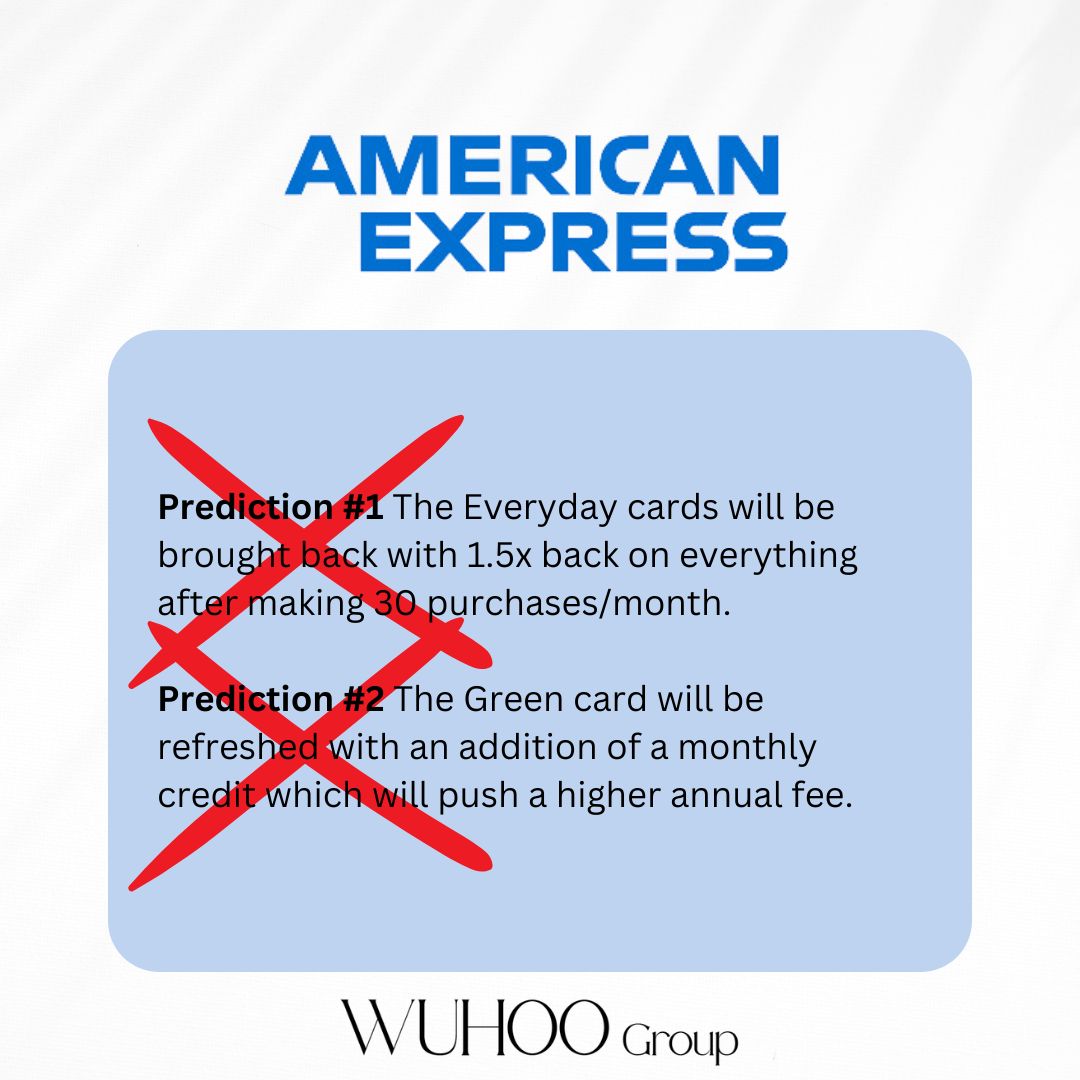

American Express did refresh several of their cards - the American Express Platinums (personal and business) being the biggest. But no changes were made to either of these cards.

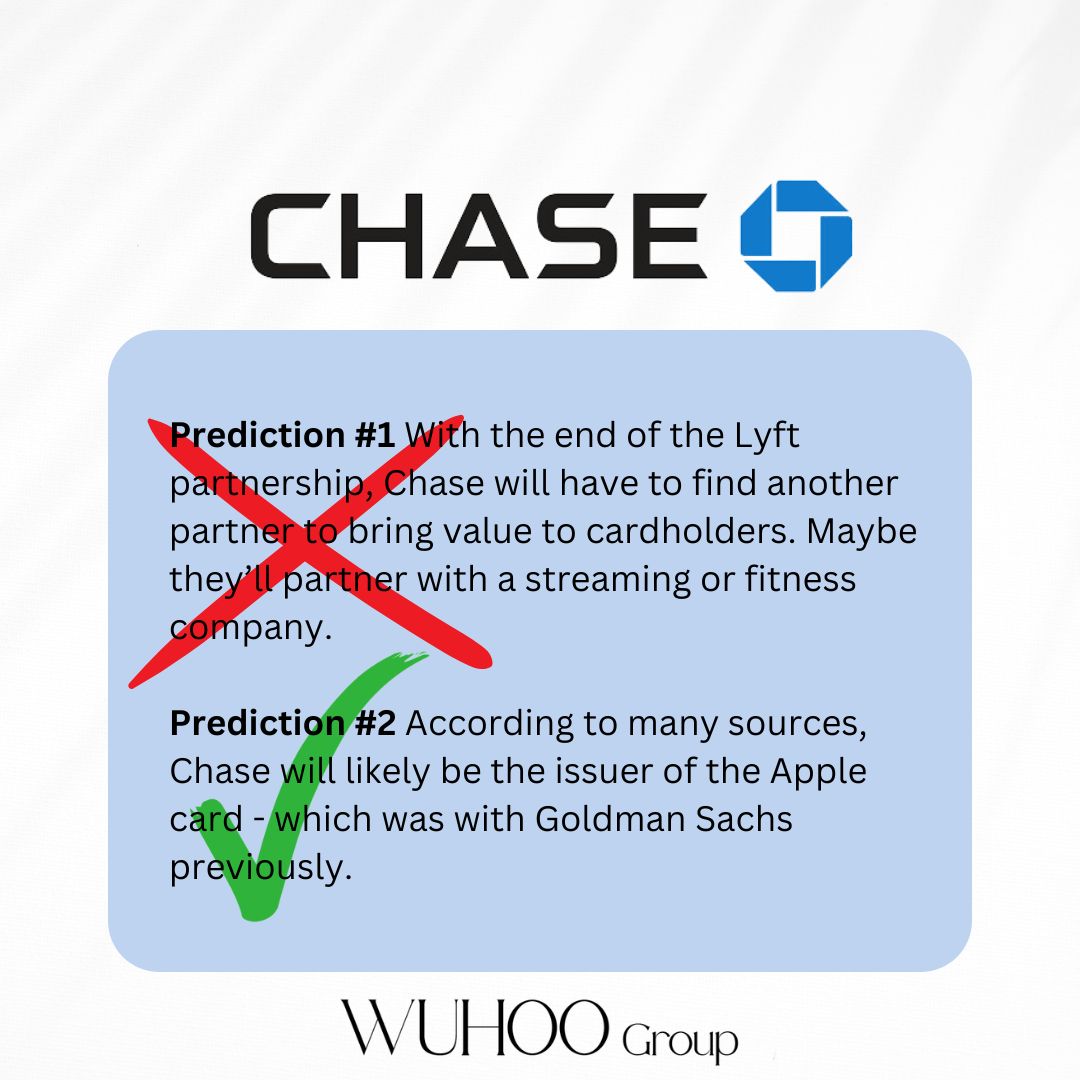

Chase went back with Lyft benefits, boo. In early 2026 Chase finally closed the deal with Apple, but I still count it!

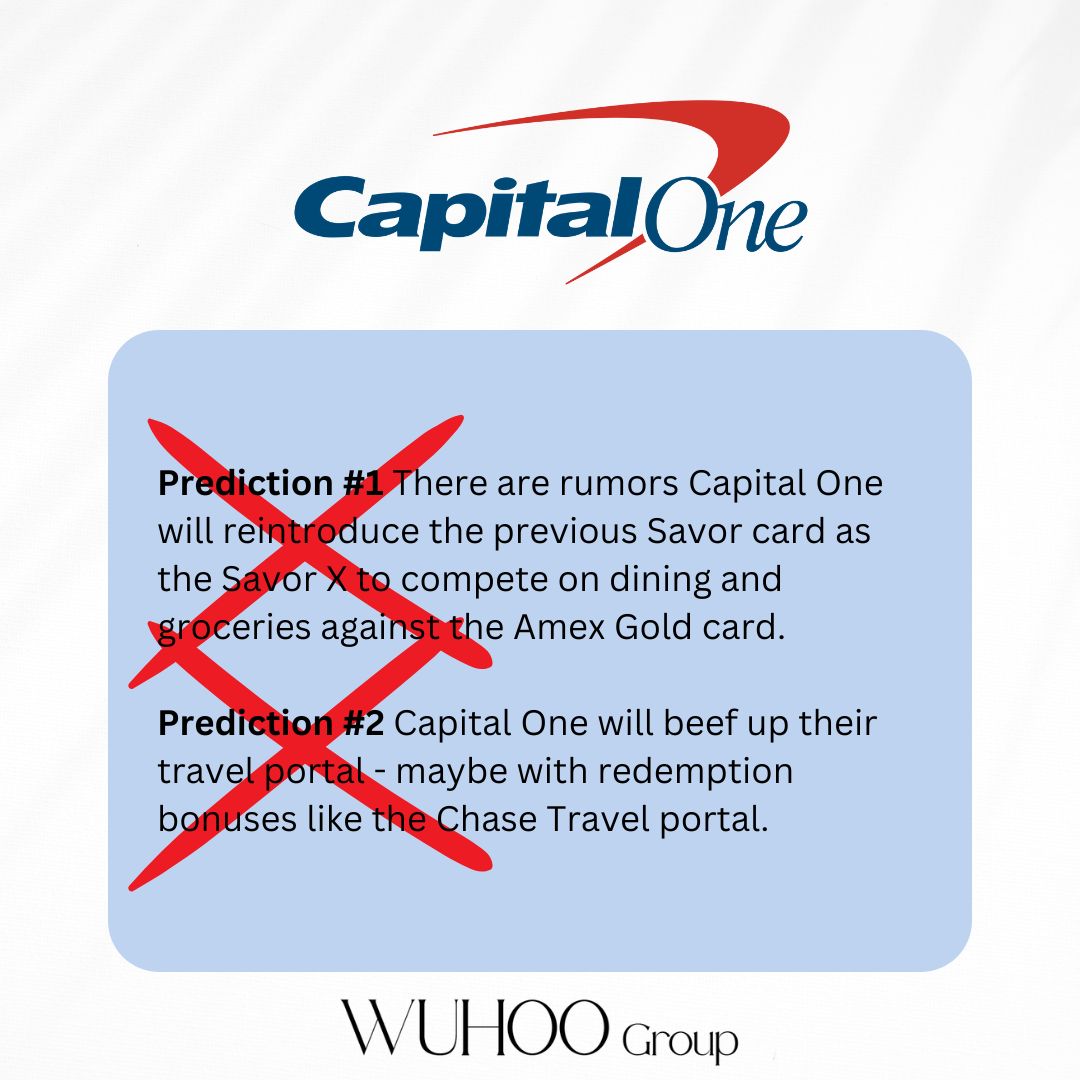

Did Capital One do anything in 2025? Just been upping their lounge game I guess

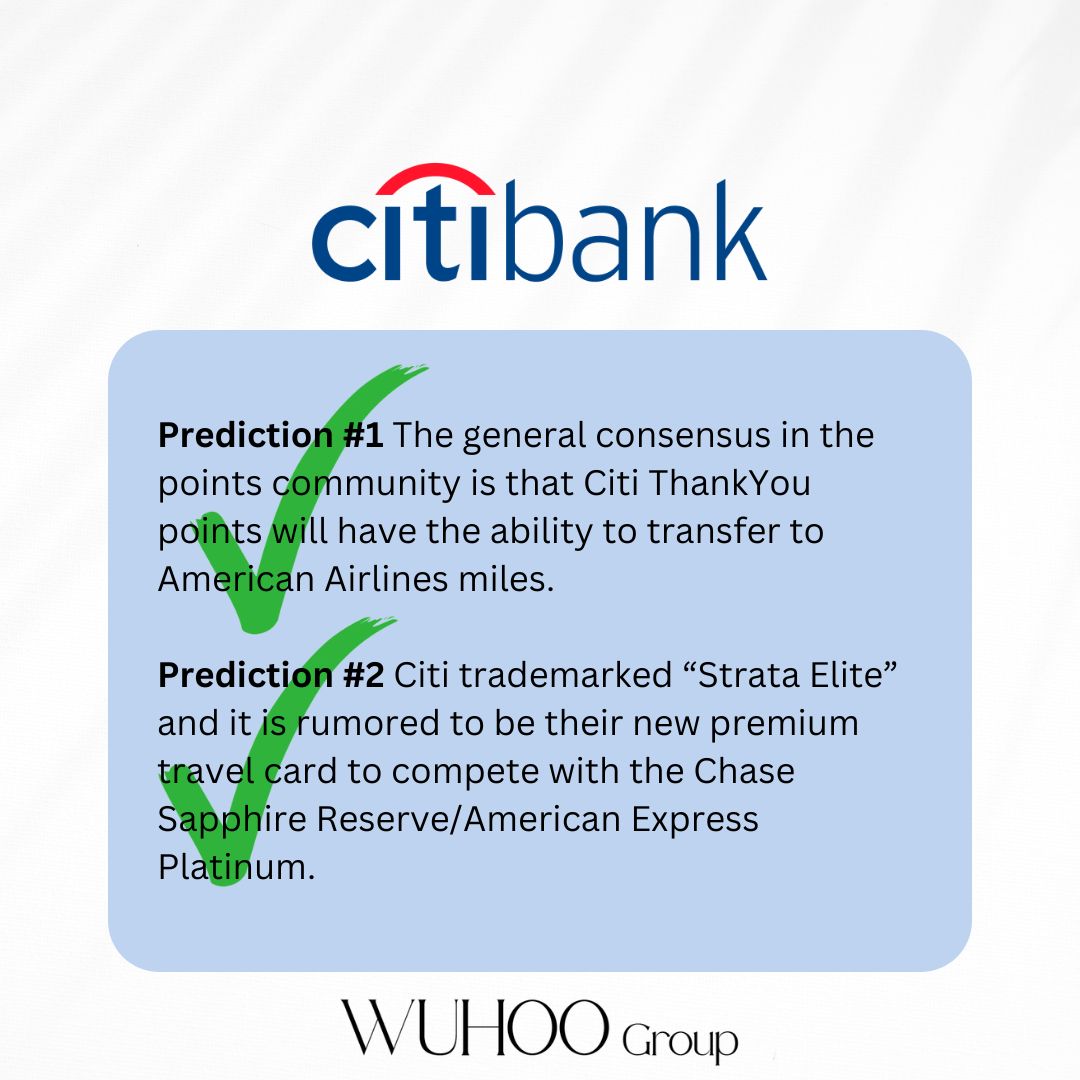

Both of these were widely speculated so I’ll just give myself one tap on the back.

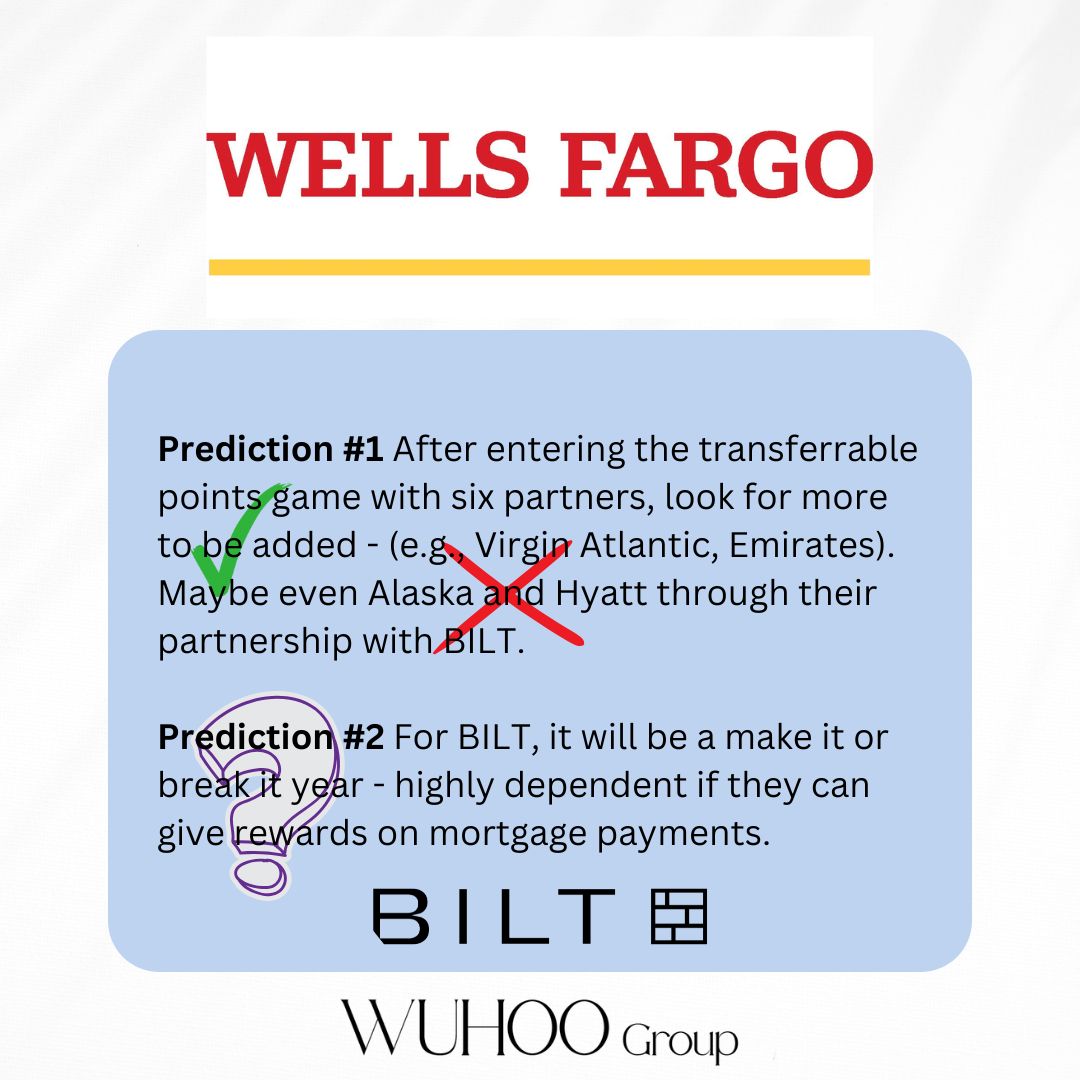

Wells Fargo did add JetBlue at a good 1:1 rate, but nothing else. And Wells Fargo successfully got rid of Bilt so….?

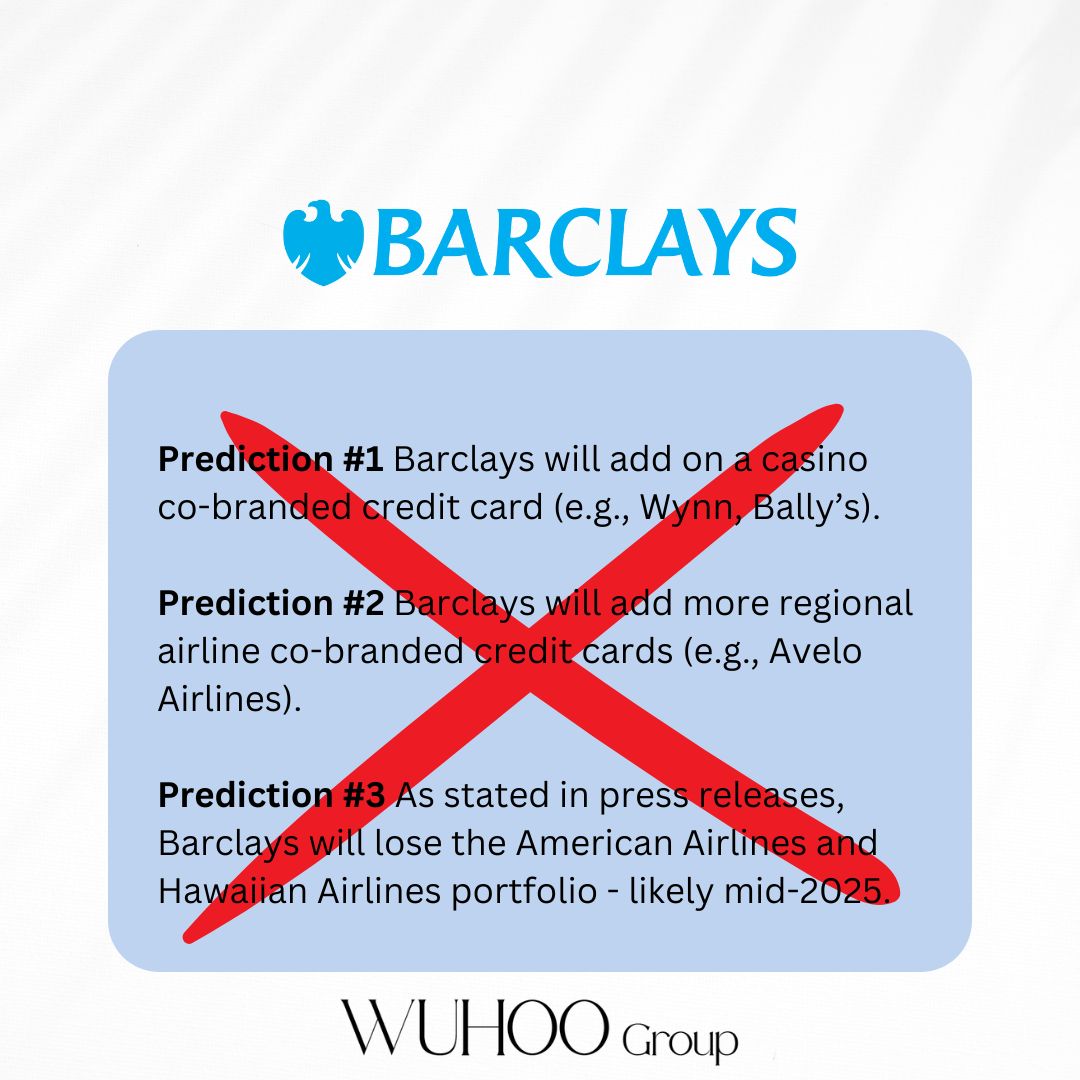

nope, nope, nope

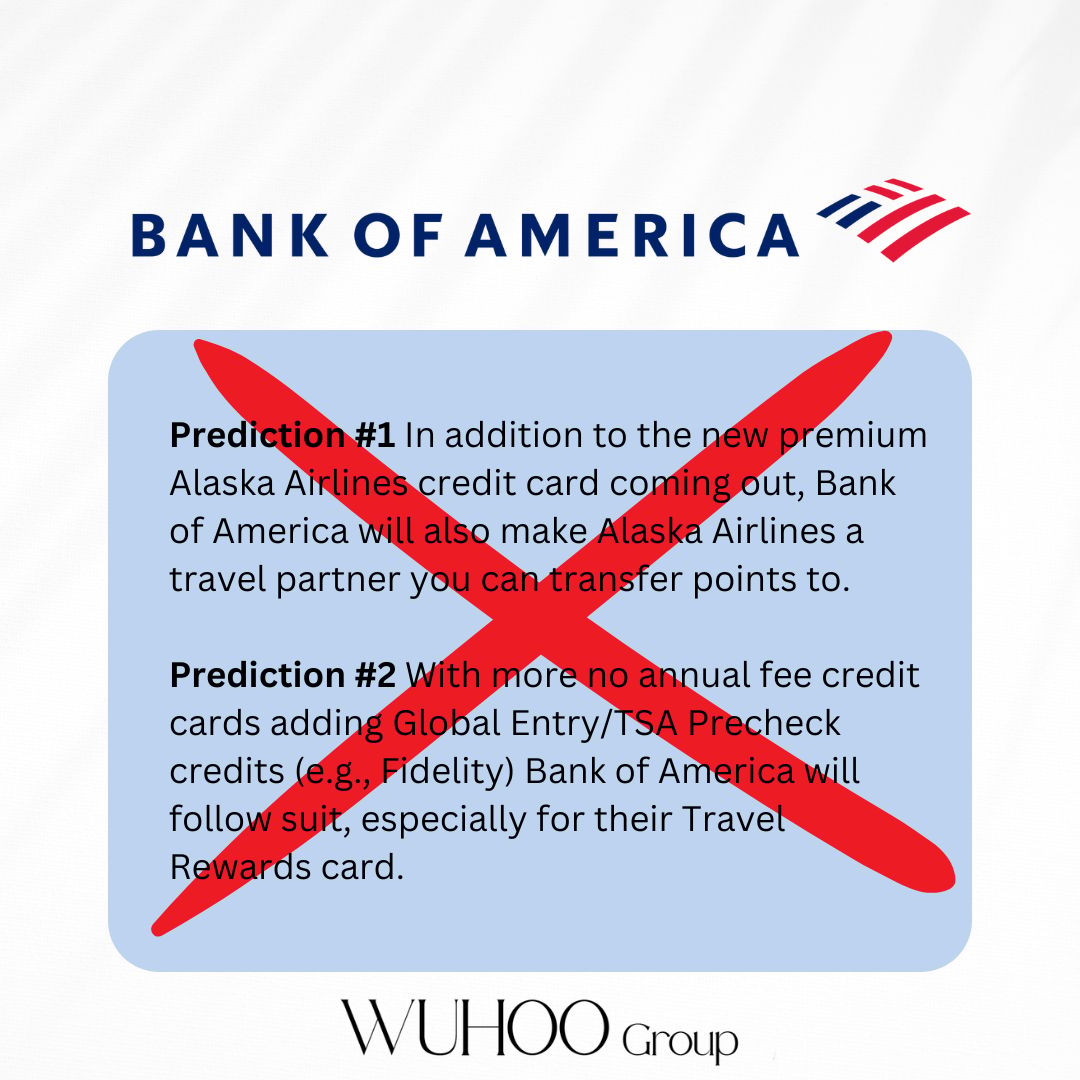

I got lazier and just stuck with one big red X. The first prediction definitely was a reach, but I thought the second was pretty realistic.

Things actually went downhill for this card so doubt they’re going to extend it.

No change with Robinhood even with more people joining. Cardless did pull Bilt though!

Weekly Credit Card Tip #48

My 2026 Predictions

BNPL products produced by credit cards/banks: Pressure to increase consumer spending, lower interest rates, and the success of BNPL fintechs are going to push traditional banks to promote their own BNPL products.

We’ve sent this start with Chase banning BNPL products with its own cards and Amex offering point incentives to turn on pay over time. Please don’t fall into the BNPL trap!

Credit cards to battle for business spending share: In 2025 we saw some awesome business credit card sign-up bonuses (Amex Plat - 300K, Venture X - 400K, CSR - 200,00K). Wells Fargo is rumored to bring more business credit cards to market. Some banks are tightening approvals for sole proprietors. All these signs points to a greater investment in business owners and capturing that market share. We’ll see more business credit cards as a whole and of course high points offers, but also key business perks like Net90 on purchases.

American Express Retention Palooza: The increased $895 annual fee and the bankruptcy of Saks will push people towards cancellation. With the all-time bonuses we’ve been seeing on Amex cards, I’m sure the math works out to give up some juicy retention offers to keep people within their ecosystem. Take advantage of this!

Psst. I just saved money with SkyKey, and you should too

I booked a flight using my United Travel Bank a month ago. Within a few weeks, SkyKey alerted me that they rebooked my flight at a cheaper price automatically. It’s a no-brainer tool to add so you don’t have to constantly check if your flight has dipped in price. They only take 25% of any savings they get you! Sign up with my link.

SkyKey Email

Our lineup for this week is below. See our rationale here just for newsletter subscribers like you.

Matthew: World of Hyatt Business

Sarah: Matt’s World of Hyatt Business | Capital One Venture X

Did you receive this newsletter from someone? Subscribe now to stay updated of new blog posts and exclusive content.

About WuhooPoints

WuhooPoints focuses on the credit card consultation side of Wuhoo Group. We help you unlock the power of your credits cards for free luxury travel.