- WuhooPoints

- Posts

- The Digital Age of Extreme Couponing

The Digital Age of Extreme Couponing

And the Credit Card Tier List Full Report

Two weeks ago we talked about using shopping portals when online shopping, but did you know you can stack credit card offers on top of that?

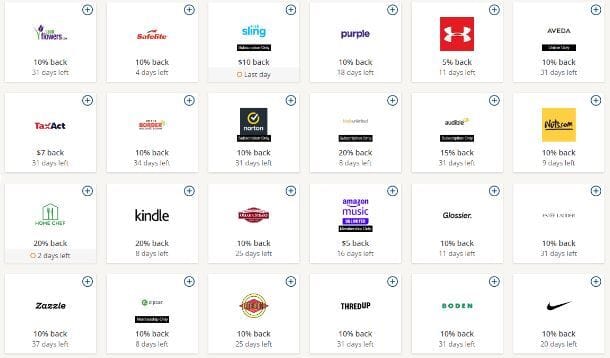

Every credit card issuer has some sort of Merchant Offer like in the image above where they will give you extra points or statement credit when making a purchase with that specific retailer. See below for some nuances for the major banks.

American Express: Look for Amex Offers, these will range from Membership Reward points to straight cashback. Not only do they offer many retailers, they sometimes to general bonuses like home insurance, spending bonuses, etc. The trick is to add all of the Amex Offers because they only show 100 at a time (both on the app and web). After you add all 100, you can refresh and see an updated list. Also, usually Amex only allows one offer per card unless you use an app like Max Rewards to hack it.

Chase: Each card has their own targeted set of Chase Offers, so think of them individually. These almost always come in the form of statement credit and not points. Annoyingly, they notify the confirmation of the offer very late.

Capital One: Offers are tied to your whole Capital One account and very integrated with Capital One Shopping.

Citi: Is it just me, or are Citi’s merchant offers just hard to find on the app and web? But they work similarly to Chase Offers

Bank of America: Work very similarly to Chase Offers

General Things to Remember

Read the fine print to see if you can make the purchase in one or multiple transactions. AND what’s the maximum return you can get.

These offers are separate from what your card normally earns and any shopping portal. So you can get credit from all three if it works out!

All of these are targeted, meaning you might not have the same set as someone else.

You can follow doctorofcredit.com to stay updated on lucrative offers

For new subscribers, I’ve been ranking the most popular US personal credit cards on Instagram. And for those who have been following along, you can now purchase lifetime access to the full report that will be updated weekly!

Amtrak Guest Rewards - Useless | No real benefits if you ride Amtrak, otherwise, why bother with this card?

Navy Federal Credit Union Flagship Rewards Visa Signature - Team Cashback | The card by itself isn’t that great of an earner, but you may value the credit union customer service and potential perks.

Navy Federal Credit Union cashRewards - Team Cashback | 1.75% back on everything, but at least no foreign transaction fees.

Navy Federal Credit Union More Rewards American Express - Team Cashback | A free card with decent earnings on spend plus Amex offers

Navy Federal Credit Union Go Rewards - Team Cashback | Not as great as the previous NFCU card

Barclays Hawaiian Airlines - Niche | Really only for those flying within and to Hawaii a lot.

World of Hyatt - Keeper | Great card to have for its free nights and acceleration to status, but the problem is deciding whether you should actually apply to this card since you can get more Hyatt points easily from other Chase cards.

Our lineup for this week is below. See our rationale here just for newsletter subscribers like you.

Matthew: World of Hyatt | American Express Gold | Chase Freedom

Sarah: American Express Gold | Capital One Venture X

Did you receive this newsletter from someone? Subscribe now to stay updated of new blog posts and exclusive content.

About WuhooPoints

WuhooPoints focuses on the credit card consultation side of Wuhoo Group. Here we help with both the accrual of points and perks and the use of points for free travel.

About Wuhoo Group

Wuhoo Group was founded in 2022 to accent people’s lives with bespoke events and free luxury travel. We are based out of Northern Virginia and are always down to help brainstorm and develop fun ideas into plans.